WTI (West Texas Intermediate) is a high-quality, light, sweet crude oil and is produced in the United States at the crude oil trading hub of Cushing, Oklahoma. The price of WTI crude oil is used as a reference for the price of other crude oil blends and oil products around the world. WTI is also used as a benchmark for other types of crude oil produced in the United States, Canada, Mexico, and South America.

For many years, WTI was considered a global benchmark crude oil. This role has largely been displaced by Brent Crude, but WTI crude still remains an important regional benchmark for North America.

Sources of WTI Crude:

WTI crude oil is produced primarily in the Permian Basin region of West Texas and southeastern New Mexico, USA. It is extracted from oil wells and then transported by pipeline to storage facilities and refineries. Some of the major producing states in the Permian Basin include Texas and New Mexico.

The major three locations of WTI crude are as follows;

1. Midland: This is the price point closest to the actual production of WTI. It is one of the main collection points for WTI in West Texas before it is sent to the Gulf Coast, Cushing, or nearby refineries through pipelines.

2. Cushing: Cushing is an intermediate transportation point where pipelines from producing regions (West Texas, Canada, Oklahoma) and refining regions (Gulf Coast and Midwest) meet. The Cushing blend of WTI is also called Domestic Sweet Blend (DSW).

The Cushing Hub delivery system consists of 35 pipelines network and 16 storage terminals. The Cushing hub has ~ 90 million barrels of storage capacity and weighs 13% of U.S. oil storage. The inbound and outbound capacity is 6.5 million barrels a day. Cushing is also known as The Pipeline Crossroads of the World.

3. Houston (Magellan East): At this location on the Gulf Coast, crude arrives by pipeline from Cushing and Midland, and it is shipped by pipe to the Gulf Coast refineries or exported by tankers to the international market. WTI blends in Houston are also called “Magellan East Houston” MEH.

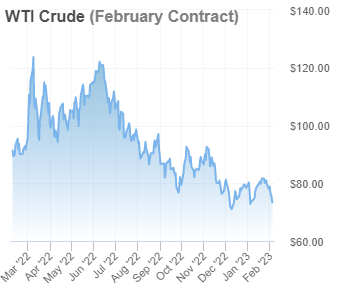

Pricing of WTI Crude

The pricing of WTI (West Texas Intermediate) crude oil is determined by the forces of supply and demand in the global oil market. WTI price is influenced by various factors, including geopolitical events, economic conditions, transportation costs, storage costs, and regional supply and demand dynamics.

WTI crude oil is primarily traded on the NYMEX (New York Mercantile Exchange), where futures contracts for WTI crude oil are bought and sold. The price of these futures contracts serves as a benchmark for the global price of crude oil and is closely watched by market participants.

The price of WTI crude oil is expressed in US dollars per barrel and can fluctuate daily, sometimes significantly, in response to changes in market conditions.

Specifications of WTI Crude Oil

The following are the specifications of WTI crude oil:

- API Gravity: 40~44

- Specific Gravity: 0.8212

- Viscosity cST @ 60 °F: 5.24

- Sulfur content: 0.2~0.34%

- Nitrogen Content: 0.08 %

- Pour Point: -20 °F

- Reid Vapor Pressure: <7.5 psi

- Asphaltenes: <0.1%

- Nickel: <2 ppm

- Vanadium: <2 ppm

- Mercaptans: 75 ppm

- Basic Sediment, water: <1%

- Light Ends, C1 ~C4: 4.35 wt %

Top References

- www.inside.mines.edu, WTI Crude oil Assay

- www.spglobal.com

- www.investopedia.com

- www.mckinseyenergyinsights.com

- www.oilprice.com

For further information, discussion and queries please comment in the box below or contact us at admin@ or follow us on Facebook & LinkedIn.